Car loan refinance made easy.

Refinancing a car loan can seem confusing, with complicated terms, unexpected fees, and potentially impacting your credit score.

That’s where we come in! Whether you’re buying new or second hand, we help you get a better deal on your car loan and avoid overpaying.

Our service is completely free, there’s no obligation and it has no impact on your credit score.

You'll speak to a real lending specialist (not a robot!) who will hand-select you the best deals, then outline your options with personalised advice to help you choose a different lender.

So if you want the perfect car loan without having to spend hours on research, get a free, no-obligation quote today!

Rated 4.9 out of 5 by hundreds of customers, with a 95% loan approval rate.

Car loan refinance, without the headaches!

Enjoy lower repayments, a better loan term and the ability to access extra repayments with more flexibility.

Lower Your Repayments

We compare 30+ trusted lenders to help you refinance your car loan with a better rate on your existing car loan. We find the best deals so you can enjoy lower monthly payments.

48 hour approval.

With Naked Loans, you can refinance your car loan in as little as 48 hours. Our streamlined process means less waiting and more savings, without the usual delays.

Award winning support.

Our award-winning support team is here to help. We’ll walk you through your refinance options, making it easy to choose the right deal for your unique financial situation.

No impact on credit score.

Explore car loan refinance options risk-free. We use a soft credit check, so your credit score stays intact while you compare lenders and find the best deal.

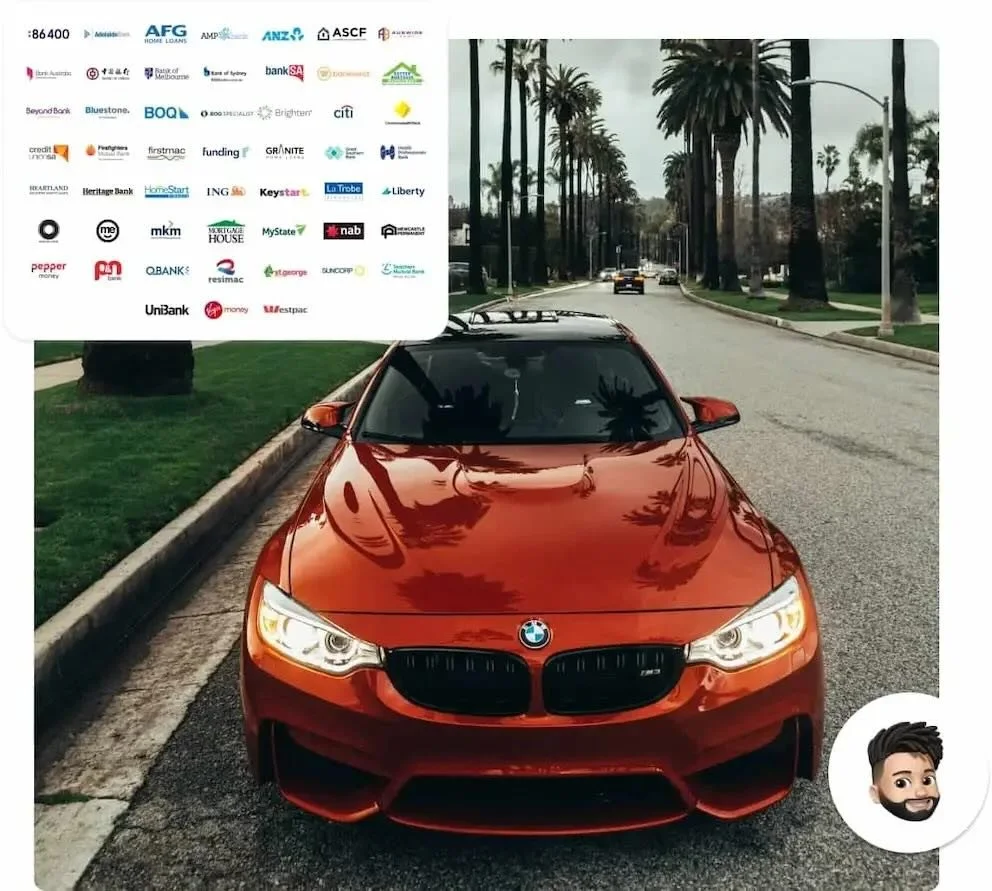

Access to 30+ different lenders

Why limit yourself to just one lender? At Naked Loans, we give you access to over 30 trusted lenders, making it easy to compare and refinance your car loan on your terms.

Whether you’re looking for lower interest rates, more flexible repayment options, or both — we’ll help you find a deal that fits your lifestyle and budget.

More choices mean bigger savings and a refinance solution that works for you — not the other way around. Ready to take control of your repayments? Send us a free enquiry today and see how much you could save on your car finance!

Car Loan Refinance: Our 4 Step Process

We make the refinancing process a breeze so you can reduce your loan repayments and save more than your original loan.

1. Apply

Start your refinance journey with a quick 60-second online application. You’ll connect with a car loan refinance specialist who will review your current loan and discuss better options tailored to your financial goals.

2. Review & Compare

We assess your refinance options by comparing 30+ lenders. We’ll highlight offers with lower rates, better loan term, or reduced fees, so you can choose the deal that suits you best.

3. Finalise New Loan

Once you’ve selected the best refinance option, we’ll guide you through the terms and loan application requirements. When you’re happy, sign the agreement, and we’ll handle the paperwork with the lender.

4. Settle & Save

The lender processes the settlement, paying off your existing loan and replacing it with your new, improved refinance deal. You’ll get final confirmation, and enjoy a lower monthly repayment!

Car loan refinance criteria.

If you meet these simple requirements, you’re eligible to refinance your car loan! Our network of 30+ lenders makes it easy to find a refinance option that works for you, with loan amounts starting from $5,000.

Stable Income

You have a steady income from employment or another reliable source, showing you can comfortably manage your new repayments.

18+ Years Old Australian

You’re at least 18 years old, an Australian resident, and have a stable living situation, giving lenders confidence in your financial position.

Loan Amount

You’re refinancing a car loan of at least $5,000. Loan amounts typically range up to $100,000, depending on your needs and eligibility.

Credit History

Your credit history shows no major unresolved defaults or serious issues, ensuring lenders see you as a low-risk borrower for refinancing.

You could be paying too much for car loan and not even realise!

Every day we talk to car owners who are paying more than they need on their current car loan, simply because they didn’t know what else was out there.

This can cost thousands over the lifetime of your auto loan. We've helped hundreds of Aussies reduce their repayments and pay off their car faster, and we can help you too!

With car loan refinancing you can save hundreds every month. We compare loans from 30+ lenders to find you the best option, explain all your options and how everything works, then handle all the paperwork so you don’t have to.

The best part? It costs you nothing! Once you’re approved we get paid by the lender, so you get our entire service for free.

So if you're ready to save, enquire about car refinancing today!

Car Loans Refinance FAQ

-

Car loan refinancing (also known as auto refinancing) means replacing your current loan with a new one, usually to get a lower interest rate, reduce your regular repayment, or change the loan term.

The new lender pays off your old loan, and you start making payments on the new loan instead.

-

Refinancing may be a good option if interest rates have dropped, your credit score has improved, or you want to reduce your monthly repayment. It can also be helpful if you want to switch lenders or access better loan features.

-

Some lenders charge fees for refinancing, such as loan application fees, settlement fees, or early exit fees from your current lender. We can help you understand these costs so you can make an informed decision.

-

Refinancing can impact your credit score, but usually only temporarily. When a lender checks your credit as part of the refinance process, it creates a ‘hard inquiry,’ which may slightly lower your score. Over time, making on-time payments on the new loan can help improve your score.

-

With Naked Loans, it can be as fast as 48 hours!

With other brokers, the refinancing process usually takes 1 to 2 weeks, but it can be quicker depending on the lender and how quickly you provide the required documents.

-

No, we don’t offer car insurance directly. However, we can refer you to a trusted car insurance partner who does.

-

We specialise in car loans and car loan refinancing. If you need help with a home loan or personal loan, we can connect you with a trusted partner who offers these services.